Living Costs in the UK

Are you relocating to the United Kingdom and unsure of how much it will cost to live there? Or are you still undecided about where you want to live in the United Kingdom?

We all know that the cost of relocating a country can’t be completely predicted, but let’s take this opportunity to learn more about the living costs in the UK.

Is It Too Expensive To Live in the United Kingdom?

It’s no secret that living in the UK comes with high costs. According to many surveys, it’s one of the most expensive countries in the world. Also, London always ranks among the most expensive cities in Europe. But your costs and savings will mostly depend on your income and your lifestyle, as it will anywhere in the world.

Living Costs in the UK

Before planning your relocation to the UK, you’d better have some ideas on the general costs of living in the country. We’ve collected this data from Numbeo in February 2024.

Accommodation

If you’re looking to rent a home, the following information may be useful in determining where to begin your search. We’ve thought providing costs in different cities will give you a better perspective when looking for accommodation.

London | |

Apartment (1 bdrm) in city center | £2,238.30 |

Apartment (1 bdrm) outside of city center | £1,629.26 |

Apartment (3 bdrms) in city center | £4,242.31 |

Apartment (3bdrms) outside of city center | £2,743.42 |

Rents in London, as the UK’s capital and a worldwide financial center, are particularly high. As a location-independent professional, you can save money by living in a smaller city or a town. Let’s look at other locations.

Manchester | |

Apartment (1 bdrm) in city center | £1,167.86 |

Apartment (1 bdrm) outside of city center | £865.00 |

Apartment (3 bdrms) in city center | £1,934.00 |

Apartment (3bdrms) outside of city center | £1,233.33 |

Brighton | |

Apartment (1 bdrm) in city center | £ 1,350.00 |

Apartment (1 bdrm) outside of city center | £1,175.00 |

Apartment (3 bdrms) in city center | £2,383.33 |

Apartment (3bdrms) outside of city center | £1,864.23 |

Cardiff | |

Apartment (1 bdrm) in city center | £1,008.33 |

Apartment (1 bdrm) outside of city center | £783.33 |

Apartment (3 bdrms) in city center | £1,590.00 |

Apartment (3bdrms) outside of city center | £1,110.00 |

Birmingham | |

Apartment (1 bdrm) in city center | £972.22 |

Apartment (1 bdrm) outside of city center | £821.43 |

Apartment (3 bdrms) in city center | £1,741.67 |

Apartment (3bdrms) outside of city center | £1,155.56 |

Transportation

In most UK cities, the public transportation system is extensively developed. The below chart shows the average costs for transportation in the country.

One-way Ticket (Local Transport) | £2.50 |

Monthly Pass (Regular Price) | £68 |

Taxi Start (Normal Tariff) | £3.00 |

Gasoline (1 liter) | £1.54 |

Food

On a regular basis, eating out can be expensive, but with so many options, you may still opt for a takeaway or restaurant meal on special occasions. In many parts of the UK, you may find local restaurants and food markets that serve dishes, products, and delicacies.

Restaurants | |

Meal, inexpensive restaurant | £15 |

Meal mid-range restaurant, three-course (for 2 people) | £60 |

McMeal at McDonalds | £7 |

Domestic Beer (0.5 liter) | £4.50 |

Imported Beer | £4 |

Cappuccino | £3.12 |

Coke/Pepsi (0.33 liter bottle) | £1.37 |

Water (0.33-liter bottle) | £1.26 |

Markets | |

Milk (1 liter) | £1.24 |

Loaf of Fresh White Bread | £1.21 |

Rice (1kg) | £1.58 |

Eggs (12) | £2.98 |

Local Cheese (1kg) | £6.86 |

Chicken Fillets (1kg) | £6.54 |

Beef Round (1kg) | £10.40 |

Apples (1kg) | £2.08 |

Bottle of Wine (Mid-Range) | £7.50 |

These are the essential costs for which you must budget. Additional costs, of course, are dependent on your lifestyle.

How Much Money Is Needed for a Decent Standard of Living in the UK?

The amount of money you’ll need each month varies depending on where you live in the UK. In cities like London, a higher income is required to live comfortably. However, this still depends on your personal expectations. Everyone is different, therefore defining what it means to live a pleasant life is difficult.

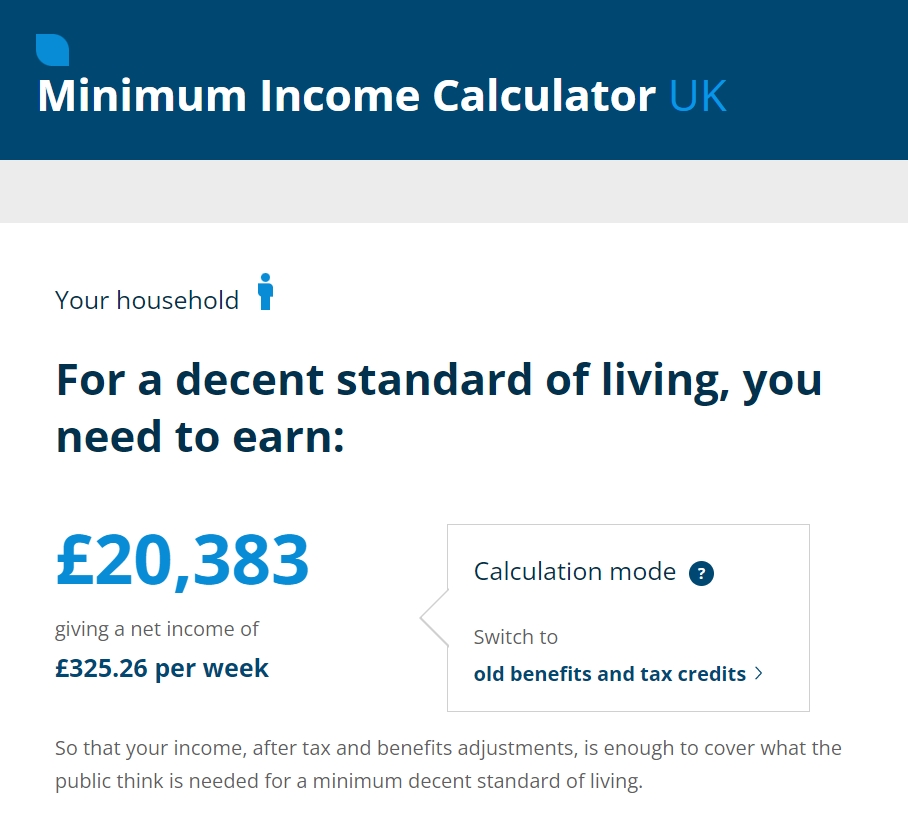

But, thanks to the Minimum Income Calculator Tool, we’ve come up with the below results.

According to the data provided by this tool, a single person needs a minimum of £20,383 per year for a decent living.

Living Costs in the UK vs. the US

We thought adding a section that compares the living costs in the UK and the US would provide a better perspective for our fellow digital nomads from the US. For this, we’ve compared London and New York, two popular digital nomad destinations.

- Consumer prices in London are 20.6% lower than in New York (excluding rent).

- Consumer prices including rent in London are 24.4% lower than in New York.

- Rent prices in London are 28.7% lower than in New York

- Restaurant prices in London are 22.5% lower than in New York.

- Groceries prices in London are 35.8% lower than in New York.

- Local purchasing power in London is 13.3% lower than in New York.

Living Costs in the UK vs. Germany

Here comes another comparison. This time we look at Berlin, a far cheaper city than London.

- Consumer prices in Berlin are 18.4% lower than in London (excluding rent).

- Consumer prices including rent in Berlin are 32.0% lower than in London.

- Rent prices in Berlin are 49.0% lower than in London

- Restaurant prices in Berlin are 32.6% lower than in London.

- Groceries prices in Berlin are 8.2% lower than in London

- Local purchasing power in Berlin is 20.6% higher than in London.

Living Costs in the UK vs. France

Paris is another expensive city, but in some categories, it’s cheaper than London. Let’s have a look.

- Consumer prices in Paris are 6.0% lower than in London (excluding rent).

- Consumer prices including rent in Paris are 27.4% lower than in London.

- Rent prices in Paris are 70.0% lower than in London.

- Restaurant prices in Paris are 13.3% lower than in London.

- Groceries prices in Paris are 18.6% higher than in London.

- Local purchasing power in Paris is 2.3% lower than in London.

The Bottom Line

Overall, the cost of living in the United Kingdom, particularly in London, is quite high. However, because of the variety of choices available, it remains a popular choice for digital nomads, entrepreneurs, and remote workers who want to explore something new. If you’re willing to be flexible about where you live in the UK, you can live comfortably without breaking the bank.