MoneyGram Review

A lot goes into sending money to someone, and it can be not easy to wade through all of the options. One such company that offers money transfer services is MoneyGram, the world’s second-largest money transfer service.

MoneyGram offers money transfers, money orders, bill payments, mobile top-up, and prepaid card reloads to individuals who don’t hold a bank account or wish to use an alternative option. MoneyGram app makes this process easier. In this article, we’ll look at what MoneyGram is and how to utilize it, as well as why to use it.

What Is MoneyGram?

MoneyGram is a money transfer business based in Texas. It has all necessary licenses and permissions in all 50 states of the United States, as well as a Foreign Transmittal License and other accreditations. The firm now services more than 200 countries and territories through its 350,000+ service locations in all corners of the world.

The best part? It provides the service of sending money internationally in a simple and quick manner. Funds can be sent to more than 20 countries via its website or mobile app. The acceptable forms of payment for this service include:

- Credit card

- Debit card

- Bank account

Top Destinations for Using Moneygram

MoneyGram serves customers in many countries and territories across the world.

Its new technologies are intended for nations, including

- United Kingdom

- Pakistan

- Denmark

- Germany

- India

- Nigeria

- Belgium

- South Africa

- Dominican Republic

- Portugal

- Norway

- Australia

This might be an obvious indication of MoneyGram’s popularity in these nations. The maximum amount you may send depends on the entranceway.

How Do MoneyGram Money Transfers Work?

MoneyGram sends money really quick and straightforward:

To get started with MoneyGram:

- Visit www.moneygram.com and create an account by providing your contact details or email address, together with a secure password.

- Enter the recipient's contact information. This includes the country where you're delivering the money.

- Tell MoneyGram the amount of money you want to transfer and how you wish to pay for it. You may pay in the United States with a bank account, credit card, or debit card. You can employ your credit or debit card to send money from the UK or pay directly from your bank account.

- You might also make payments in cash at an agent location.

- MoneyGram delivers cash to the receiver. Some transactions may be completed in a matter of minutes.

Is MoneyGram Good For Transferring Money Abroad?

People have a common question as to whether this provider is suitable for sending money abroad. For ex-pats who are based overseas or want to send cash back home, it offers a convenient way of transferring funds. While MoneyGram is known for rapid and dependable international money transfers, it can be one of the most costly alternatives for many individuals.

MoneyGram money transfer has higher costs and a more significant markup on the mid-market exchange rate. This entails you may end up paying more to send the same amount of money using MoneyGram than with another comparable service.

How To Get Started With Your MoneyGram Account?

By going to MoneyGram’s website, you may sign up in just a few minutes:

Step #1

Click on the "Sign up" switch, fill in your name, email address, phone number, and create a secure password.

Step #2

The next move is to set up a profile. You may also be asked to confirm your account with a government-issued ID, like your passport or driver's license.

Step#3

After you've established your account, you can either log back into the website or download the MoneyGram app ( feasible for both iOS and Android) to finish the process.

Step#4

Plus, be sure you have your ID, the recipient's information, and the sum you wish to transfer in cash (it needs to be more than enough to cover agent fees).

With MoneyGram, you may transfer money to and from a variety of currencies and locations. Bank transfers, cash payments, home delivery (depending on the sending and receiving countries), mobile wallet transfers, and prepaid phone top-ups are all available.

Before you press “Send,” double-check your recipients’ information to avoid unexpected delays. If your recipient is receiving cash, they’ll need a valid government-issued ID and the reference number of your transfer to establish their identity at the agent office in their nation.

The Pros and Cons of MoneyGram Transfer

MoneyGram has a long record of being a trustworthy money transfer provider. Its customer base and distribution network are vast. MoneyGram, like any other service provider, has its drawbacks. Both the benefits and disadvantages are listed below.

Pros of MoneyGram:

- Multiple Access Points: The MoneyGram platform is a great way to send money, with multiple access points. You have an option to use their MoneyGram online transfer service at one of their stores, transaction staging kiosks, or even independent agents.

- Lower Transfer Fees: Sending money to bank accounts is cheaper. Sometimes there are no transfer fees. If you send cash, the transfer fee will be lower. It will cost only £3.99 for transfers up to £6,000 with some corridors. It makes MoneyGram transfer more budget-friendly.

- Extensive Agent Network: MoneyGram is a company that provides many services, including sending and receiving money. They have more than 350,000 thousand agents in 200+ countries worldwide to make their service easier for people all over.

- Faster Transfers: Transfers may take minutes or hours to complete, depending on the recipient location and payout option. Mobile wallets and cash pickup locations are the quickest ways to get money. Bank accounts can take anything from a few hours to a day to finish.

- Payout Flexibility: You may choose whether your recipient gets the money transfer as a straight deposit in their bank account, mobile wallet deposit, cash pickup, or prepaid card when sending money.

Cons of MoneyGram:

- Lower Exchange Rates: The exchange cost margins MoneyGram prices can go as extreme as 5.05%. The higher the margins, the lower the rates, and this means you'll get less money per unit of the sending currency. The charge with most money transfer services varies from 0.5 percent to 3.5 percent.

- Lower Threshold: When it comes to transferring money across borders, some corridors have high limits, whereas others, such as Mexico and Kenya, only allow up to $990 and $708, respectively. When sending funds to acquire capital-intensive assets, this might be restricted.

MoneyGram Fees and Rates

When MoneyGram completes transactions, it incurs fees for both exchange rate margins and transfers. On the MoneyGram website, a cost estimator displays how much you’ll pay for your transfer.

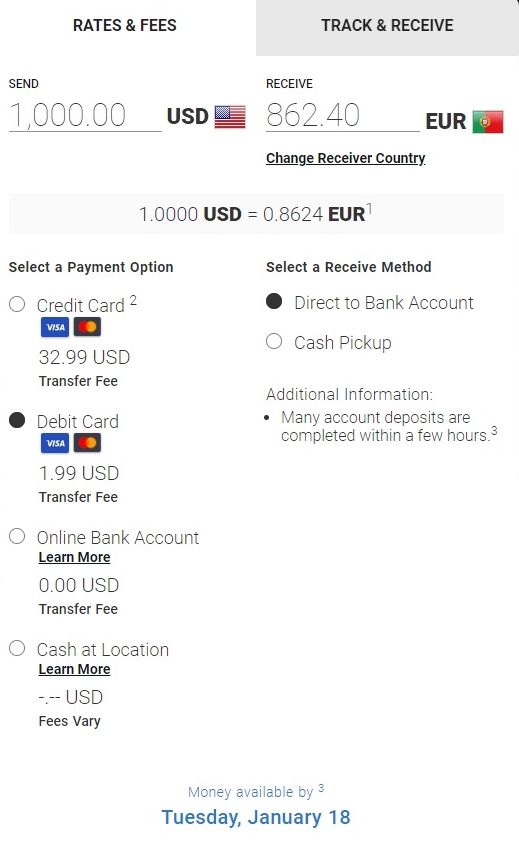

We’ve done a calculation on the MoneyGram website. Here’s the estimated cost calculated on the 13th January 2022, for a transfer from the US to Portugal.

Transfer Fees

Moneygram fees are fewer for each transfer than average. The expenses fluctuate depending on the amount, destination, payment method, and payout option selected. For example, sending £500 to the US costs £3.99. Sending the same amount from your bank directly to a bank account in Malta would incur no fees, but using a cash pickup service would cost £3.99. However, sending money in the same currency has no fee.

Exchange Rates

The margins MoneyGram charges on currency pairs are dependent on the exchange rate. When sending money from GBP to EUR, you’ll pay around 5.05% more than the mid-market rate. Transfers of the same amount to Australia in AUD will cost 4.23% more than the mid-market rate.

Other MoneyGram Fees

There may be costs associated with using a third-party service. MoneyGram’s fees are based on the payment method you select. Paying via credit card, for example, might incur both a cash advance charge and interest on the amount advanced.

It’s best to pay via bank and have the money transferred straight into the recipient’s bank account for the most excellent results in fees and costs.

Money Receiving Options With MoneyGram

There are several options for receiving money worldwide through MoneyGram. However, some of the possibilities may be restricted in your destination country.

Cash Pick up

Money can be collected at any MoneyGram agent location. The cash is generally available for pick up in 10 minutes after the transfer has been submitted, depending on agent hours and compliance with regulatory standards. Available in all the nations.

Account Deposit

You may pay your recipient directly by bank account. Many transactions are completed within a few hours, and some even less than an hour. Depending on the country, funds availability in your receiver's account varies and is subject to banking hours and systems accessibility, excellent funds availability, approval by MoneyGram verification systems, local rules and regulations. Many firms, including those in the financial sector, tend to disregard weekends and holidays.

Mobile Wallets

Sending money to someone's mobile wallet account is fast and easy. You can send it typically within minutes after submitting the transfer, which will reliably arrive at the receiver's bank account in no time. The recipient's mobile wallet account linked to the sender's mobile number will be credited. Some MoneyGram locations are equipped to handle mobile wallet transactions. Transfers to mobile wallets are available at select agent locations.

Send to Card

You may send money directly to the debit card of your beneficiary. The funds are delivered to the card, usually within minutes after the transaction has been completed and accepted, depending on the agent and system availability. Available in some nations.

Home Delivery

You may send cash to be delivered in person to the recipient's house address. A local MoneyGram agent will provide the money, depending on the agent's business hours and compliance with legal standards. Only available in some countries.

FastSend

FastSend is a great service that lets you know when someone sends money to your phone. When they do, just click on the link in the text message and choose how to deposit it into your bank account, either with debit card information or by giving out account number and information.

Alternatives to MoneyGram

If you’re already familiar with Moneygram, check out Wise. It's one of the most popular methods of money transfer, especially among digital nomads. Here is our comphrensive full Wise review.

Who Is MoneyGram Right for as a Service?

MoneyGram is best suited to people who need cash deposited directly into their bank account or picked up at an agent location. MoneyGram is also great for those who can’t establish a bank account but want the convenience of paying by debit card. It also allows you to send money to more than 200 different countries via its website or app.

What Do Reviews Say About MoneyGram?

MoneyGram has an overall rating of 4.4/5 on Trustpilot, with over 14,000 ratings and 68 percent of the respondents claiming to have an excellent experience. Overall, they praised the simple mobile app and quick transfers in most cases.

Also, the MoneyGram app is available for download on Android and iOS devices. On Google Play, the application has a rating of 4.6/5.0 with over 60,000 votes, whilst on the App Store, it has a rating of 4.8/5.0 and over 260,000 reviews.

Is MoneyGram Safe?

In most of the places they operate, MoneyGram is a registered and licensed financial services company. For example, they’re authorized and regulated by HMRC in the UK, permitted to do business in all 50 states, D.C., and all U.S. territories, as well as the National Bank of Belgium in Europe.

MoneyGram uses strong anti-phishing protection to safeguard your personal information and money online. MoneyGram online transfer also urges its customers to double-check the credentials of their beneficiaries, verify that their recipients have valid identification, and avoid responding to any emails from MoneyGram requesting passwords or other personal information.

The Verdict: Is It Worth Opening a MoneyGram Account?

MoneyGram is a fast, convenient way to send money that will be delivered in minutes. MoneyGram money transfer is the best option for people who want to send money quickly. They are reliable, have a wide network of locations, and offer great rates on transactions. Plus, MoneyGram transfer has never had any security breaches so far.