Monzo Review

Mobile banking has become a dominant force in the industry by challenging traditional banking.

We are now leaving the era of going to bank branches and waiting in long queues. We can make bank transactions with a few clicks via our smartphones or tablet.

In this blog, we will cover Monzo, the leading British bank in the industry. We will look at the pros and cons, benefits, and fees of Monzo, which allows you to manage your bank account via online banking wherever you are in the world.

Monzo international transfer is one of the good alternatives in today’s digital age, so let’s get to know it better now.

What Is Monzo?

Founded in the UK in 2015, Monzo Bank is one of the industry’s first app-based mobile banks. UK-based Monzo online banking is used by approximately five million people today.

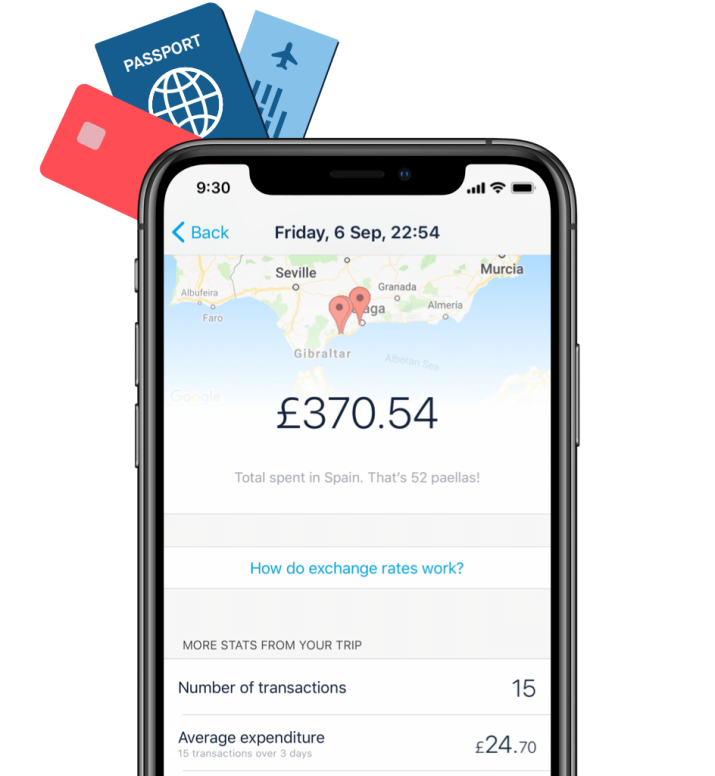

Monzo offers various opportunities to entrepreneurs and provides very stylish features for business accounts. There is also a Monzo account opening opportunities for teenagers. Monzo allows you to spend your money abroad and presents you with a report on your return expenses. It includes features such as opening a joint account and sharing your tabs and the ability to make quick payments at any time.

Monzo Bank offers more advantageous and cheaper international transfers and cash withdrawals than traditional banks. Thanks to its advanced mobile banking, it makes it possible for you to manage money and save. It helps you set savings goals and budgets through Monzo online banking.

Monzo Benefits

Pros

- Monzo Bank relies on the Financial Conduct Authority (FCA) to provide deposit protection outside general safeguards.

- Monzo online banking application is convenient to manage, spend and save your money.

- You can benefit from interest while saving.

- You can open Monzo account with your family or a friend to save and share expenses.

Cons

- Monzo does not have high savings rates.

- Monzo is not the best option for international transfers and withdrawals as it uses Mastercard's exchange rates.

- Monzo Bank charges a fee of £1 for every deposit on your account.

- You have a withdrawal limit when abroad. When you exceed this limit, it charges 3% on your transactions.

- There is no credit card option at Monzo Bank.

Monzo Review: Current Accounts

Monzo Bank, like other banks, offers free and paid account opportunities with various advantages. Fees and amenities vary depending on the account type and card you choose. The higher the account level and price, the more possibilities you get.

Monzo Current and Monzo Lite

If you want to open Monzo account and use your account more simply, this account type is for you. You can open commercial or individual accounts and benefit from some free opportunities. For example, you can make withdrawals of up to €200 abroad and pay a three percent fee for subsequent transactions.

Monzo Plus

For £5 per month, you can have a more equipped account with Monzo Plus.

Some features of Monzo Plus are as follows:

- Virtual cards

- Detailed and advanced summaries

- Tracking credits

- Possibility to withdraw up to €400 while abroad

- Checking multiple Monzo accounts from the Monzo online banking app

- Categorize spending by location or type

- Holographic card

In addition to these features, you can make one free cash deposit. Finally, do not forget that the minimum subscription period is three months.

Monzo Premium

With Monzo Premium, you can open a Monzo account with advanced features for £15 per month. The minimum subscription period for Monzo Premium is six months.

Monzo Premium unlocks more features than other account types:

- Free withdrawals of up to £600 while abroad

- Possibility to deposit five times while abroad for free

- Worldwide travel insurance

- Phone insurance

- 1.5 percent interest rate

- High-quality metal card

- Discounted airport lounge use

See the comparison below table to have a better idea about the Monzo accounts and how they differ:

| Monzo | Monzo Plus | Monzo Premium | |

UK current account | ✓ | ✓ | ✓ |

Google Pay & Apple pay | ✓ | ✓ | ✓ |

Fee-free money withdrawal abroad | £200 | £400 | £600 |

Interest on your balance | X | 1% | 1.5% |

Virtual cards | X | ✓ | ✓ |

Worldwide travel insurance | X | X | ✓ |

Phone insurance | X | X | ✓ |

Price (monthly) | Free | £5 per month | £15 per month |

Monzo Business Account Review

With a Monzo Business account, you can monitor your account better. There are two different types of Monzo Business accounts, paid and free.

Let’s quickly compare some of its features:

Pro | Lite | |

Cost | £5 per month | Free |

Tax pots | ✓ | X |

Integrated accounting | ✓ | X |

Multi-user access | ✓ | X |

Billing | ✓ | X |

Exclusive offers | ✓ | X |

6 months Xero free | ✓ | X |

Card Shipping

If you live in the UK, card shipping is free. However, the Monzo international transfer delivery fee is £30.

An Alternative: Wise

If you're sending money internationally on a frequent basis, you might want to check Wise, formerly Transferwise. With Wise, you can send over 50 currencies through the real exchange rate, not the tourist one. This is one of the biggest highlights of Wise.

Thanks to its low fees and transparent rates, Wise is one of the best alternatives in the world of ever-evolving online money transfers.

Monzo Online Banking App

As I’ve mentioned earlier that Monzo Bank does not have any branches. For this reason, you have to do all your transactions from Monzo’s mobile application. Also, Monzo doesn’t have a desktop version so you’ll manage your money from the app on your phone or tablet.

Monzo’s online banking application is easy and reliable to use. Monzo’s Google Play and App Store scores are pretty high. Honest user reviews also show how good the Monzo online app is.

Making Payments with Monzo

You can use your Monzo card and app to make transfers and payments.

It works with Monzo Bank, Apple, and Google Pay. In this way, you can create automatic payments and make pending payments. The Monzo app will warn you ahead of time and helps you avoid surprises if next month’s payout is high.

In addition, you can create a personal and secure link with the application and share it with any recipient. Thanks to this link, the buyer views and checks the details and receives the payment instantly.

Monzo Bank Reviews: Cards

Monzo Bank sends a debit card of your choice for current accounts. If you have a Monzo Plus account, these cards can be holographic.

In addition, users with a Premium Monzo account will have a metal card that is more stylish than other Monzo account cards. The logos and details of the metal card made of stainless steel sheets have been carefully designed. Both plastic and metal cards feature contactless transactions.

You can use these cards, which are valid worldwide, free of charge. You have to pay the Mastercard exchange rate as an extra.

Virtual Cards

Only customers with Plus and Premium accounts get a virtual card. Virtual cards have a unique ID. In this way, you can make your online use more secure. Your card’s information will not be damaged when there is a security breach on the sites where you use your card. Users with a Plus account can issue virtual cards up to five times. You can start using it right after you have a virtual card. You can obtain your virtual cards through the Monzo online banking application.

Monzo Bank Reviews: Is Monzo Safe?

Since 2017, Monzo has been included in the financial services compensation scheme (FSCS). This means your money is safe for up to £85,000.

Extra security measures are as follows:

- When you make a payment, you will receive an instant notification.

- Monzo asks you to confirm online payments and set up encryption with PIN, fingerprint, Face ID, or Touch ID.

- Monzo app does not send passwords to ensure maximum security. Instead, it sends a link to your email address, and you can click and log in.

- You can block and unblock your Monzo card at any time.

Monzo Review: Monzo Customer Support

Monzo Bank provides online customer service. From the online help center, you can get information and support about operations such as managing your account, creating a budget, making mobile payments, and getting an overdraft account.

Additionally, Monzo has an online forum and encourages its customers to ask questions and make criticisms there. In this way, you can learn about the products by reading the discussions created by other users.

You can get help from Monzo customer service via phone or live chat line for all your questions. You can contact support from the 24/7 chat line for urgent questions and from 7 a.m. to 8 p.m. for other questions.

Monzo vs. Starling

Monzo Bank and Starling Bank have advantages in many ways. If you can’t decide between the two when making an international transfer, let’s compare both banks in terms of fees. In this way, some points may be decisive for your choice. Ultimately, both banks can provide different benefits for international transfer.

| Monzo | Starling | |

Multi-Currency accounts | No | No |

ATM withdrawal fees | Free in the UK | Free |

International transfer fee | £0.5 | £5.50 delivery fee |

International transfer | 0.35-2.00% | 0.4% transfer fee |

There you have it! We’ve given you an introduction to Monzo bank and how you can benefit from it.

Have you ever used Monzo? Let us know how your experience was…

Frequently Asked Questions About Monzo Bank

What is Monzo?

Monzo Bank was one of the first app-based mobile banks in the UK, having launched in 2015. Approximately five million people in the United Kingdom use Monzo internet banking.

Entrepreneurs have a variety of options with Monzo, including highly fashionable features for business accounts. There is also a Monzo account for teenagers who want to use it. Monzo lets you spend your money overseas and gives you a report on your expenses when you return. It has features like the opportunity to open a joint account and share tabs, as well as the ability to make rapid payments at any moment.

What are the Monzo benefits?

With the Monzo online banking application, you can easily manage your money, make your payments and control your expenses. You can also benefit from interest on your savings account. In addition, you can open a joint account from the Monzo application and view your costs and savings in detail with the person you are making.

What do I need for a Monzo open account?

Anyone over 16 and residing in the UK can open a Monzo account. When opening your account, you must have your identity and address information. You must enter your phone, e-mail, and date of birth. You also need a smartphone as Monzo doesn't have a physical branch. You must download the Monzo app on your Android or iOS device. Finally, the app will ask you for a selfie video for account security. In this way, sound and image identification is made.

Is Monzo safe?

Monzo is involved in the financial services compensation plan (FSCS) alongside top-of-the-line safeguards. Thanks to this fund established by the government, your savings are secured against the possibility of the bank going bankrupt. In addition, you get instant notification from the app when you spend. You must verify with a PIN, Face ID, Touch ID, or fingerprint for your online purchases. Monzo does not send a password as an extra security measure but instead sends a link to your email. Finally, you can block and remove your account at any time. In other words, I can say that Monzo has taken severe security measures and is a reliable banking application.

What are the Monzo account types?

Monzo has several account types, paid and free. It is divided into Monzo Current, Monzo Plus, and Monzo Premium. The pricing and advanced functionality of these accounts increase, respectively. Additionally, you can open a paid or free business account.