Remitly vs. Wise | Costs, Limit, Speed

There are several payment services that facilitate international fund transfers. Given the different benefits and features, it’s natural to get confused while settling down for one. Remitly and Wise are two great options and also strong competitors. So, in this article, we will run a thorough comparison of Wise vs Remitly to help you decide on a better option.

Remitly VS Wise

Many people still choose the traditional method to send money through a bank despite its higher charges when making an international transfer. On the other hand, online payment services are much more affordable. Coming back to our discussion, Remitly and Wise both were launched in 2011, and they have been close contenders ever since. But the efficiency of these options is subject to some factors like safety and speed. So, which one should you choose? Remitly or Wise?

What Is Remitly?

Headquartered in Seattle, Remitly was founded by Matthew Oppenheimer, Josh Hug, and Shivaas Gulati in 2011. It allows transferring money directly to bank accounts, a cash pickup location, a mobile wallet, or delivered to home. Remitly serves around 3 million active monthly users. The platform provides efficient and affordable services.

Remitly is available in 17 countries and can send money to more than 50 countries around the world.

What is Wise?

Wise, formerly Transferwise, has its roots originating from the UK. Launched in 2011, the FCA-approved fund transfer service Wise rapidly grew, and as of now, it has served over 8 million users. Founded by Taavet Hinrikus and Kristo Käärmann, it provides a varied payment structure that potentially reduces transfer fees.

Wise’s coverage extends to 59 countries and you can send money to 80 countries.

Let’s go deep into the comparison of Wise vs Remitly.

Remitly VS Wise: Comparison

Costs

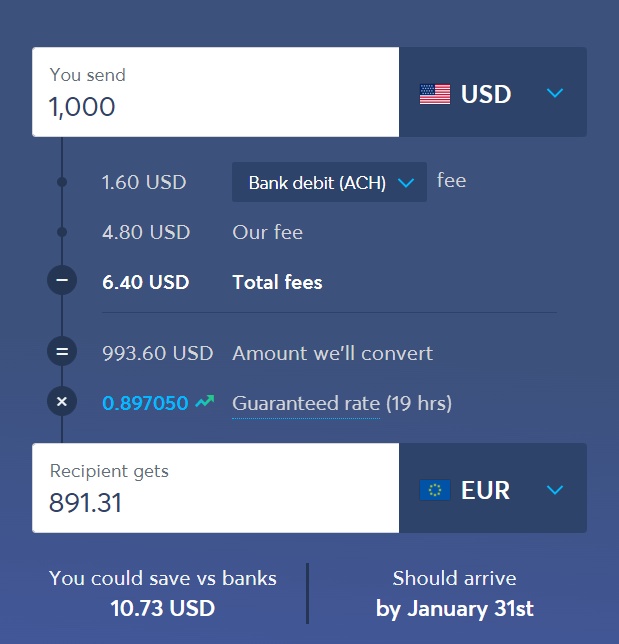

Remitly charges a flat fee depending on the amount. The standard price is $3.99 if you’re transferring less than $1,000, and if it’s above $1,000, no fee is applicable. The same fee structure applies to both ways of sending money: Express and Economy. However, there’s an additional fee of 3% for credit card transactions.

Wise has a transparent fee structure and offers mid-market transfer rates. The fee also depends on the currency, the method of transfer, and the amount. Wise charges you 0.35% to 1.65% of the amount you’re transferring. However, if you want to transfer EUR outside the SEPA, there will be additional charges of €3.55 plus the Wise fee.

Verdict: Since Remitly charges less fees on transferring above $1,000, it’s ideal for transferring large amounts. However, for the smaller amounts, Wise would work best.

Safety

The security features on Remitly are reliable and serve well. From their email verification to log-in and fund transactions, everything is protected with high levels of security. Remitly uses two-factor authentication. Apart from that, it utilizes a Secure Socket Layer (SSL) with 256-bit encryption to secure the server.

Wise is approved and regulated by FCA. It uses two-factor authentication to protect every transaction and is GDPR compliant. Wise is SOC 1 type, SOC 2 type, and ISO 27001 certified. Moreover, the app and website also apply advanced encryption to keep your data secure.

Verdict: Both of these services are adequately protected, and you won’t face safety issues with either of them.

Customer Reviews

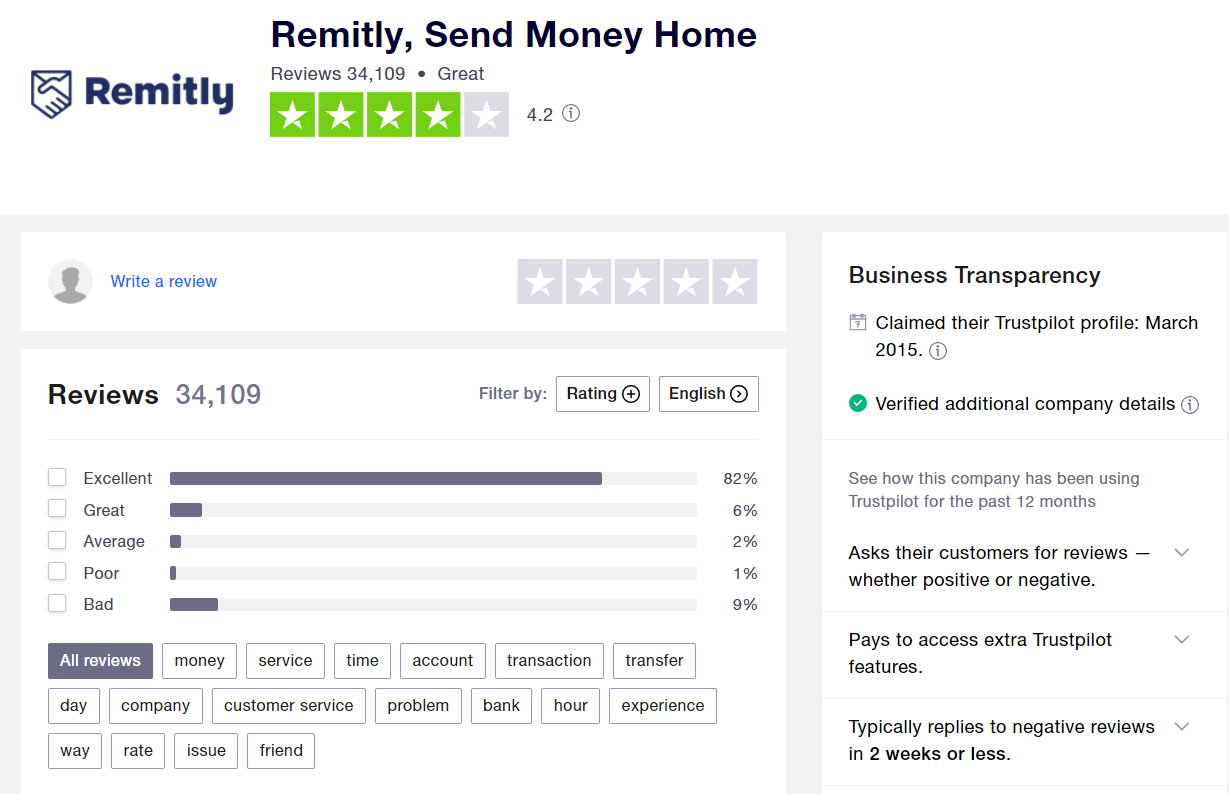

Remitly has a rating of 4.2 over 5 on Trustpilot.

The present 34,109 reviews give mixed opinions. Some people liked the smooth transactions, while others faced some issues with speed and customer care.

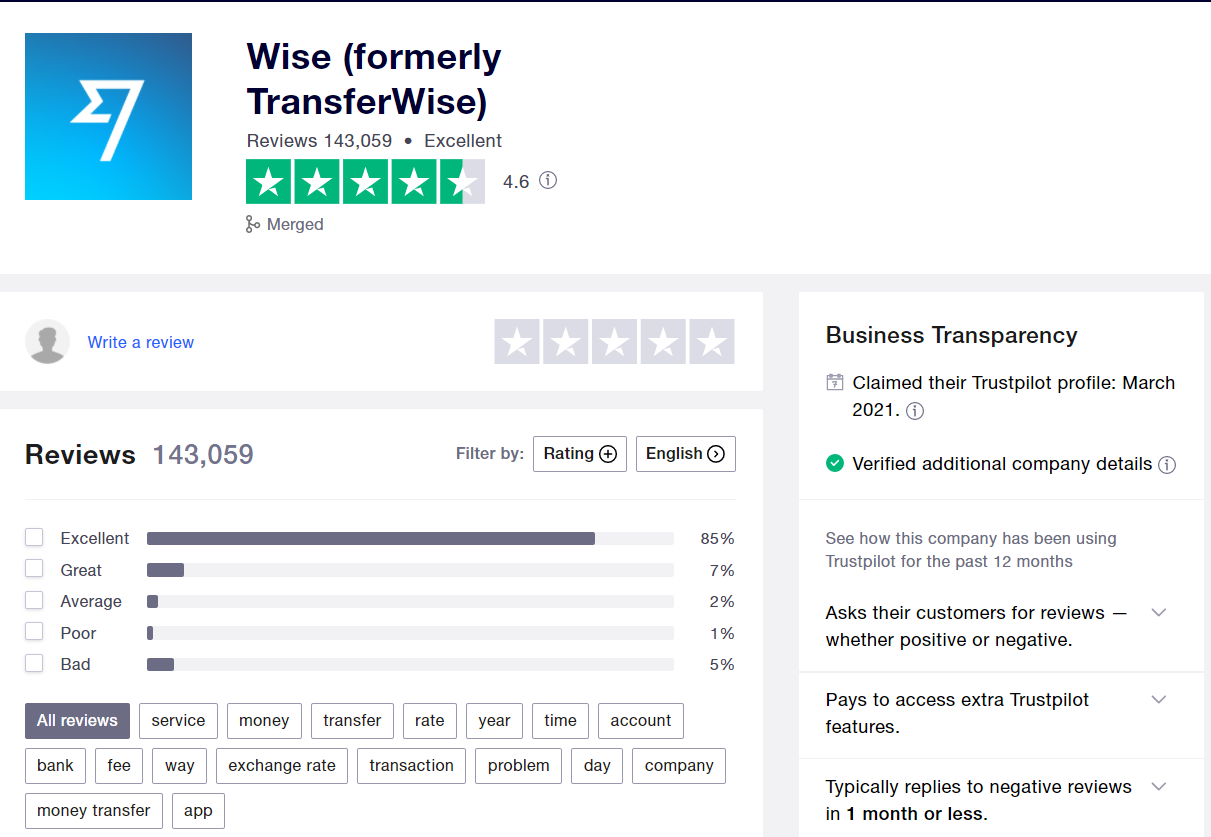

On the other hand, Wise has a 4.6 out of 5.

As of January 2022, 143,059 users have left their reviews, and around 82% of them have given 5 stars. The users have stated that Wise has low fees and the transfers are fast.

Verdict: Wise has an overall better rating and customer reviews. It implies that people consider Wise more reliable.

Speed

As we mentioned above, the transactions done with Wise and Remity are secure, but what about the speed? Let’s see how they compete in this.

Remitly provides two ways of sending money. The first is the Express option that transfers your money within minutes. In contrast, the Economy option takes about three to five business days to complete the transaction. Both of these services can be used at standard prices. The same scenario applies to credit card transactions.

The speed of completion of a transaction mainly depends on the currency, amount, and mode of payment. Additionally, whether the payments were made on weekdays and weekends also affects the speed. A transaction done on a weekday will be completed in one or two days, and if it’s during the weekend, it will take three or five days.

Verdict: For regular payments, Wise takes up to two days compared to Remitly’s five-day period. However, the Express option in Remitly is instant, but there’s a fee for every transaction under $1,000. It’s helpful in making urgent payments, but for regular payments, Wise is more suitable.

Let’s quickly take a look at the advantages and disadvantages of Transferwise vs Remitly.

Advantages of Remitly and Wise

Above, we discussed the performance of these services as per the different deciding factors. Now let’s quickly glance through the advantages of Transferwise vs Remitly to make things even more evident.

Pros of Remitly

- Most suitable for instant/quick transfers

- Has two ways to send money: Economy and Express

- It’s cheaper to send large sums of amount

- You can transfer to bank accounts, cash pickup locations, and wallets

- Provides easy tracking option for senders and receivers

Pros of Wise

- Low charges and transparent fee structure

- Ideal for making small amount payments

- FCA approved and regulated

- Trustpilot reviews are very good

- It’s not compulsory for the recipient to have a Wise account

Disadvantages of Remitly and Wise

The disadvantages can clear any doubts in your mind. That’s why we created a list of disadvantages of Remitly vs Transferwise.

Cons of Remitly

- Expensive for smaller transactions

- Mixed reviews from users

- Normal transactions are comparatively slow

- Great customer support: accessible in different languages via phone and email

Cons of Wise

- Doesn't have the option of instant transfer

- Cash pick up, or wallets transfer not possible

- Only bank to bank or card to bank transactions

Conclusion: Remitly VS Transferwise | Which One To Go for?

So, with this thorough examination, we can say it comes down to personal preference. You can use the one that suits you better.

Both Remitle and Wise are great from a security point of view. For cost-effective and overall service, Wise is a better option. However, for urgent payments or multiple payment options, Remitly can help. We hope you find all your answers in our Remitly vs Wise article.