Wise Virtual Card: All You Need To Know

Are you a Wise user? Do you have a Wise debit card? So, you should also consider getting a Wise virtual card too which you can use from your devices, with the real exchange rate. If you have a Wise virtual card, you don’t need to carry your wallet, and there is no risk of your credit card being stolen.

Let’s find out more!

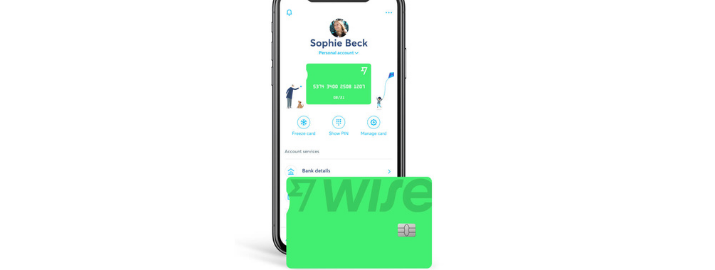

What Is Wise Virtual Card

Wise virtual card is a digital card that exists exclusively on your phone/laptop. With the added layer of protection of the Wise digital card, you get all the benefits of the Wise card: Spend online, in-store, and overseas while saving on currency conversion fees.

With Wise virtual card, there’s no need to bring your wallet, and there’s no risk of your credit card being stolen. Your virtual card differs from your physical card in terms of details, and it can be frozen after each purchase. That means it’s a safe, smart, and easy method to spend money no matter where you are.

You can hold 50+ currencies at once, convert them in real-time with the free Wise app, and use your virtual card to spend online, in stores, and internationally.

To obtain the Wise virtual card, you must first order a real Wise card. But you won’t have to wait for your real card to arrive before using your virtual card.

If you already have a physical card and live in the United Kingdom, Australia, New Zealand, Singapore, Malaysia, Switzerland, the European Economic Area, Brazil, or Canada, you can receive a digital card.

The Advantages of Using the Wise Virtual Card

- Make online payments and keep your virtual debit card frozen after each purchase.

- Your virtual card number is distinct from your real Wise card number. This provides an additional layer of protection for your purchases.

- You can have up to three virtual cards and use them to track your spending by utilizing various cards for different sorts of expenses.

- Using Apple Pay, Google Pay, or any virtual wallet of your choice, shop wherever contactless payments are accepted, all at the true exchange rate.

- After you've ordered your real card, you can acquire a Wise virtual card and start spending right away in the Wise app.

Customers with personal or company Wise accounts are eligible for a free Wise virtual card (except for customers in the US or Japan).

How To Get Your Wise Virtual Card

In just a few minutes, you may create a free Wise account and order your physical card. To get started, open a balance in any of the 50+ currencies available and fund your account.

The virtual card option is found in the Wise app under the “digital card” tab. Slide your cards to the right until the purple card shows up. Select “Get a digital card”. Alternatively, go to the cards tab on the website and look for the same option. That’s all there is to it.

For whom is the virtual card ideal?

- For those who seek an extra layer of protection while traveling overseas.

- For ecommerce customers who want to be sure their financial information is safe when shopping on new sites both at home and abroad.

- Virtual cards save plastic waste for environmentally minded customers.

- For those who are wondering where their wallet is, your virtual card is stored totally online in your Wise account and may be accessed at any time.

Key Takeaways

- The Wise virtual card isn't actually a physical card. This means it can't be taken and used again.

- After each purchase, freeze your card within the app, then unfreeze it when you're ready to use it again.

- If you don't trust the firm you're buying from, use your virtual card information instead of your primary card information.

- If you suspect your account has been hacked, replace your card information right away.

- Set up subscriptions with your virtual card and then freeze it to prevent any additional purchases from being charged without your permission.

- Your Wise virtual card is compatible with Apple Pay, Google Pay, Samsung Pay, Fitbit Pay, and Garmin Pay.

Note: We use Wise official website as our source of information but note that Wise can change any of these features from time to time. So, before you open your account or make a commitment, make sure you read the terms for the most updated information.