Wise VS N26 | Costs, Limits, Speed

If you’re a digital nomad traveling frequently, you’re going to need an account abroad. So it’s time that you get to know two important players: Wise and N26.

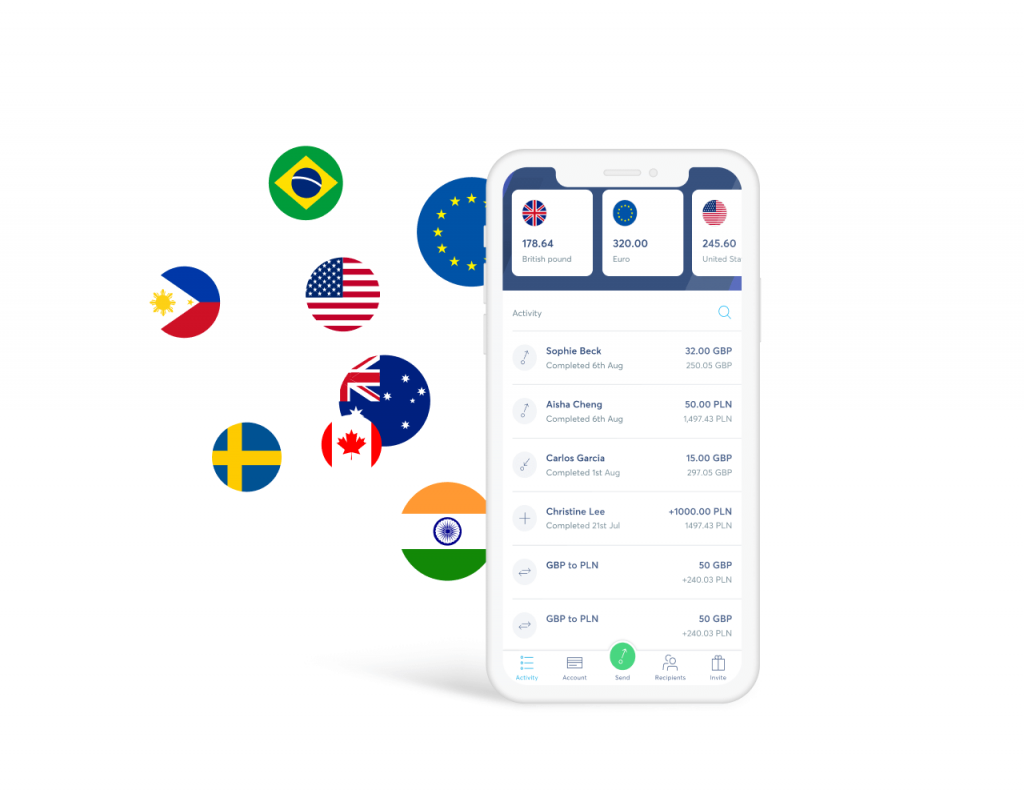

Created in 2011 in the UK, Wise, formerly TransferWise, is based in London and specializes in international money transfers. Wise has created the Wise account, a multi-currency account, ideal for travelers, expats, and those who work as self-employed people. Wise is famous for its low exchange rates.

The N26 Bank is a financial startup in Germany, based in Berlin. It’s a digital bank, without any agencies. All financial transactions are done online. N26 is a pioneer in digital banking thanks to the vision and services it provides.

In this article, we’ll introduce them and compare their features, such as rates, speed, and ratings. After that, you can choose the provider which suits your needs most. Let’s begin!

Wise VS N26

N26 and Wise’s Multi-Currency Account are two top-tier fintech platforms that provide users with a variety of valuable features and services. While the two companies share some similarities (such as Wise’s money transfer technology being integrated into N26’s banking platform), Wise’s bank-like multi-currency account is ultimately a totally different offering than N26, which is a full-fledged direct bank aimed at a different market.

N26 and the Wise Multi-Currency Account are both good providers that offer a variety of current financial services. The Wise Multi-Currency Account is designed to conduct international money transfers easily, while N26 offers a full-featured bank account. If you’re attempting to decide between the two, we’ve got you covered.

Wise or N26: Comparison

Costs

Bank N26 has the N26 account, which is free, with no maintenance fee, and other types of account, such as N26 You, N26 Smart, N26 Metal, and N26 Business, which have maintenance fees. With the free N26 account, you’ll pay a 1.7 percent fee for each withdrawal. With the others, there will be no fees charged for the withdrawal, only the exchange rate.

The Wise Account is free too and does not have a maintenance fee. With it, you can withdraw up to £200 monthly, free of charge at ATMs.

The currency is converted automatically, according to the real exchange rate, with no profit margin, and the fee costs between 0.35% and 2%, depending on the currency to be converted.

Safety

N26 Bank is totally safe . It has the HTTPS seal, which guarantees you safe navigation. Also, the safe browsing certificate (padlock) protects you against internet risks.

N26 uses the SSL protocol in all its transactions so all bank details entered are encrypted and your information is protected.

Wise is also safe. The financial institution is authorized by the Financial Conduct Authority (FCA), of the United Kingdom, and legalized in all countries where it operates, is regulated by central banks and regulatory bodies.

It’s possible to safely browse the Wise platform, which follows the HTTPS protocol and has the padlock symbol in the page address, indicating that it’s possible to browse the platform safely.

Coverage

With Wise, you can send money to over 50 countries, save and manage money, and use your multi-currency account to send money to any currency available on Wise.

N26, on the other hand, operates in 25 countries in Europe.

Customer Reviews

According to the Trustpilot, Wise has a higher rating than N26. Wise has received a 4.6 out of 5 ratings, which is considered great. N26’s score is 4.

On Trustpilot, Wise has more than 125,000 reviews. Wise’s users like how simple it is to use. It’s also cost-effective and provides quick transfers.

N26 has around 18,000 reviews. What users like about N26 are that it’s quick and user-friendly.

App

Both N26 and Wise have good ratings on both the Apple Play Store and Google Play Store.

N26

- Google Play Store Review Score 3.8/5 (95k reviews)

- Apple App Store Review Score 4.5/5 (6k reviews)

Wise

- 4.4/5 (135k reviews)

- 4.7/5 (21k reviews)

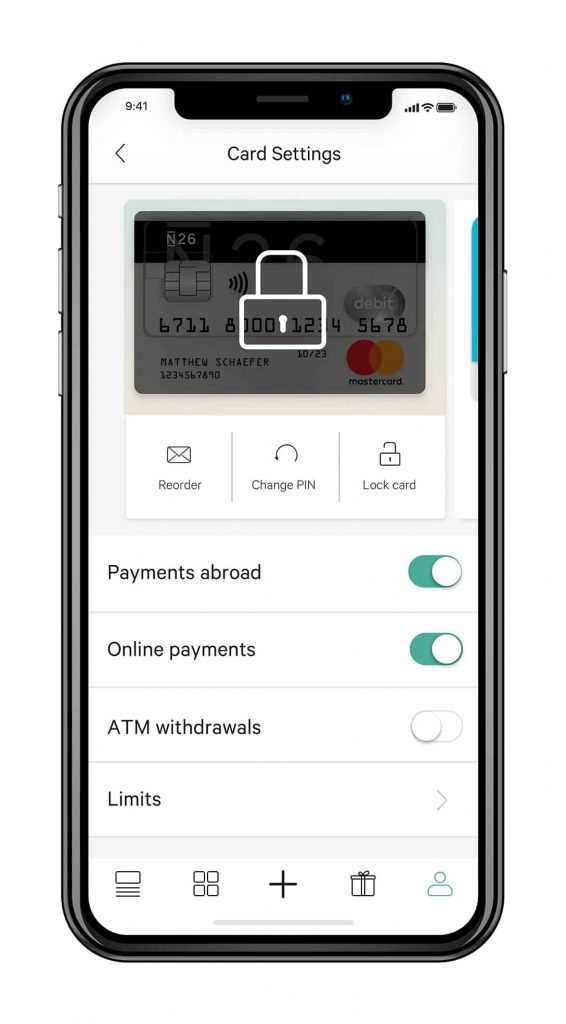

With the N26 app, you can lock and unlock the card, set your spending limit, and do other functions. In addition, the bank sends a push notification for every purchase you make so that you are aware of everything that happens.

With the Wise application, you can carry out all transactions, and manage your multi-currency account and many other features.

Account Opening

Both have simple platforms to open the account, and opening the account can be done in a matter of minutes. But as to the requirements for opening an account, it’s easier to open a Wise account.

Just register, fill out your profile and send the requested documents to be verified. Soon after, you can start sending and receiving money to countries.

Some requirements to open an account on N26 are to be over 18 years of age and have an address in one of the countries where N26 operates.

Verdict – Which Is Better: Wise or N26

N26 has a wider range of services than the Wise Multi-Currency Account, making it a better choice for consumers searching for a full-service bank. Wise’s services, on the other hand, are fantastic if you’re looking to send money internationally, or store foreign currencies.

Have you ever used N26 or Wise? Please share your experiences with us. If not, you might want to check our Wise Review and N26 Review as a start.